14+ paycheck calculator north dakota

Use ADPs North Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Supports hourly salary income and multiple pay.

How Much Does Recruiting From Scratch Pay In 2022 15 Salaries Glassdoor

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

. North Dakota levies a progressive state income tax with five brackets based on income level. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Just enter the wages tax withholdings and other information required.

Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck. Need help calculating paychecks. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in North Dakota.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. North Dakota Paycheck Calculator.

This makes South Dakota a generally tax-friendly. Overview of North Dakota Taxes. For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year.

As mentioned above South Dakota does not have a state income tax. To use our North Dakota Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This free easy to use payroll calculator will calculate your take home pay.

The state is notable for its low income tax rates which range. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. There also arent any local income taxes.

North Dakota Hourly Paycheck Calculator. Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota. The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

North Dakota Hourly Paycheck and Payroll Calculator. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. After a few seconds you will be provided with a full.

The 2022 wage base is 147000. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Calculating paychecks and need some help.

North Dakota Paycheck Calculator Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Amazon Seller Fees The Ultimate Guide For Fbm And Fba Sellers

North Dakota Salary Calculator 2022 Icalculator

Southpoint Apartments 3450 Ruemmele Road Grand Forks Nd Rentcafe

North Dakota Income Tax Calculator Smartasset

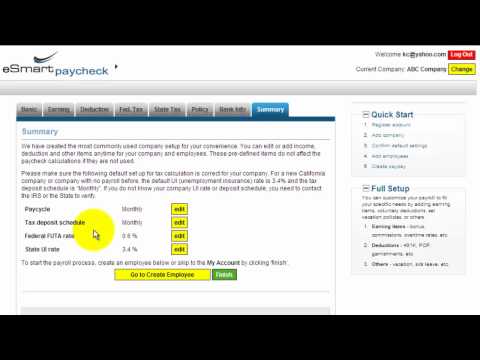

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Dakota Digital Mlx Led Replacement Upgrade Gauges 14 2021 Harley Touring Bagger Ebay

Credit Line Banking

Southpoint Apartments 3450 Ruemmele Road Grand Forks Nd Rentcafe

Free Paycheck Calculator Hourly Salary Usa Dremployee

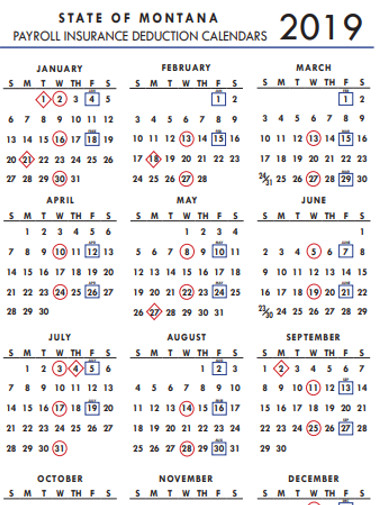

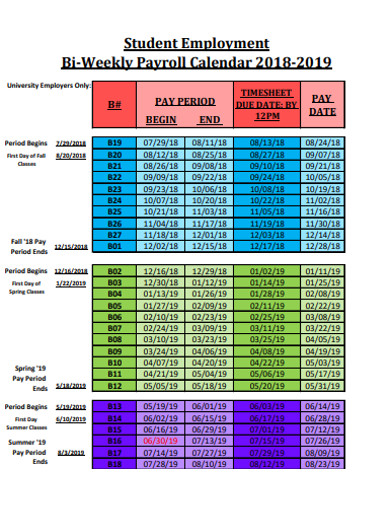

Payroll Calendar 19 Examples Format Pdf Examples

Payroll Calendar 19 Examples Format Pdf Examples

Paycheck Calculator Us Apps On Google Play

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Axos Bank Reviews What Is It Like To Work At Axos Bank Glassdoor

North Dakota Paycheck Calculator Smartasset